Ready to be Debt Free?

Being in debt is scary, especially if you are living paycheck to paycheck. It can rob you of sleep, cause anxiety, even break up marriages. It takes away your choices, and puts a dent in your self esteem.

Debt is very powerful indeed.

However, you can take back the power and gain control of your debt. And, you don’t have to go it alone!

If you are ready to be debt free taking the first step is always the hardest. It may feel overwhelming at first but once you do these few things, you will be in the best position to get those balances to zero!

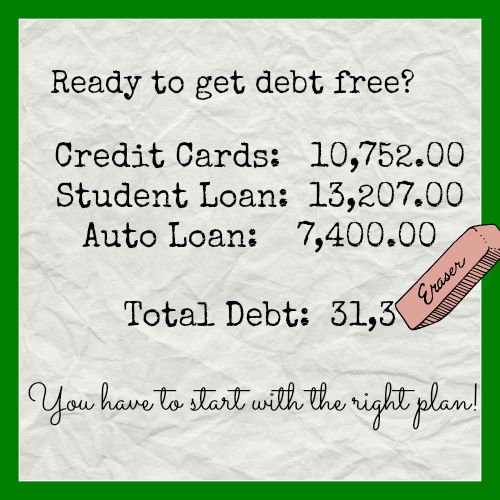

1. Own up to your debt.

This is a biggy. Many people in debt have no clue just how bad (or sometimes not as bad) the situation really is. If you have a significant other, it is important to do this together. Dig out all your statements.

Yes, this means opening up all the ones you have been too afraid to look at! Include ALL debts (except your mortgage) such as credit cards, student loans, medical debt, family debt. Everything. Take a deep breath and total it up.

2. Track your spending

Right down each and every dollar you spend for a week or so and find out where your money leaks are. Too many trips through the drive through? Do you really need that coffee shop latte every morning, or could you make it at home? Not making a meal plan before your shop for groceries?

Tracking your spending with give you a clear picture of saving opportunities that you might be missing.

3. Make a plan.

Now that you know the true numbers, as bad as they may seem, it is time to make a plan. Yes, that includes making a budget! Trust me, it will change your financial life!

The hardest part is now behind you. It is time to get the wheels moving forward.

There are so many really great on-line resources to help you along the way, and I have gleaned valuable tools from several of them.

I am happy to share the resource that has helped us the most in our debt free journey!

(This post does include affiliate links. I will earn a small commission if you decide to join the Debt Proof Living community by clicking through one of the links. This does not change the cost to you. I am just pleased pass on the links for you to learn more about it and decide whether it might work in your own debt free journey!)

Many years ago when we found ourselves getting deeper into debt I was desperate for a solution. I came across Mary Hunt’s best seller, Debt Proof Living, How to Get Out of Debt and Stay That Way.

After reading the book cover to cover in one weekend, I was elated to find her website Debt Proof Living! It has been a constant place for support, frugal living tips and resources, and a lively online forum where you can share your successes and challenges with a host of others who are either still on their debt free journey, or have already gotten to debt free and are staying that way!

I am sure if you have done any online research about debt repayment you are familiar with the snowball method. In a nutshell, you pay off your smallest balance, and then snowball that payment in the next and so on, and so on until all your debts are paid. A very wise plan indeed.

The highlight of Debt Proof Living is the Rapid Debt Repayment Plan. Mary has used this as the back bone of becoming debt free for since the 1990’s. It is a calculator that allows you to enter all your debts, in any order and then it summarizes a Repayment Plan that will cut YEARS off your journey to debt free! It saves it for you and you can go in and enter each payment and watch the numbers fall!

When I first entered our debts into the calculator our summary indicated that it would take 1201 months to become debt free if we kept up with just the minimum payments. That is 100 years people! My entire lifetime and then some. And the total interest paid in those 100 years would be in the six figures! Yikes!

By using the RDRP through Debt Proof Living we were able to knock 96 years and 1 month off that timeline, not to mention cut about 75 to 80% off the interest paid!! Can I hear an AMEN!

The key is that right from the start committing to paying a fixed amount to each debt even if the minimum payment gets smaller each month. This, coupled with the snowballing payments makes all the difference in the world! If you can throw on a bit extra for a booster payment and you will be debt free in no time.

While this tool has been invaluable to us during our debt free journey, there are so many amazing features that makes it more than worth the low yearly fee!

The Debt Proof Living promotes:

- Spending less than you earn

- Giving and saving consistently

- Making educated financial decisions

- Living free of consumer debt

- Having a specific plan in place to guide your success

Learn effective, longstanding money management

- The 10-10-80 financial formula

- Develop a spending plan (aka: budget)

- Establish and build a contingency fund

- The Rapid Debt Repayment Plan to get your debt paid down fast

- Establish a Freedom Account for those irregular expenses such as car repairs, home maintenance, etc.

You will have at your fingertips

- Interactive forums to put you in touch with others who are following a debt free lifestyle

- Access to the Rapid Debt Repayment calculator and manager to keep you on track

- A manager to track your Freedom Account

- Interactive tools including over 40 other financial calculators

- A monthly newsletter packed with money-saving tips and resources

- Access to archives of every single past newsletter at your fingertips

- Video resources including a “boot camp” to get you started on the right track

After owning up to our debt and putting a plan in place by signing up for the Debt Proof Living community we immediately did two things:

Stop accumulating more debt

Cut up your credit cards, put them in a bowl of water and freeze them if you cannot bear to cut them up. Whatever it takes you must STOP taking on new debt now.

Learn to shop with cash

Leave your debit cards at home. Shop only with the amount of cash you have budgeted for each week. Yes, this will require a trip to the bank to withdraw some cash.

Have regular budget meetings

Being on the same page as your partner makes the journey so much easier. I am not saying this always goes smoothly, but it gives you both the opportunity to have your say in how your money works for you!

Pay yourself first

It is essential to have a contingency fund, as we all know life doesn’t always go as planned. You might not be able to commit to 10% right now, but you will get there! If you are saving nothing now, then putting away even $5 week is a step in the right direction.

There are so many ways to boost your contingency fund such as selling your excess, reducing your cable plans (or eliminating them all together), look into less expensive cell phone plans, pick up extra shifts at work, or even consider a second job if need be. Just be sure to bank those extra dollars!

While we are still on our debt free journey, it is such a relief to know there is a light at the end of the tunnel, and the tunnel is much shorter than we initially expected it to be! And having someone in our corner who has been deeply in debt herself, providing resources and encouragement has taken the anxiety and fear out of facing our debts head on!

If you are interested in learning more about Mary Hunt and her Debt Proof Living community, I suggest you visit Debt Proof Living today and decide for yourself it this is the debt-free plan for you!

Until next time…..

Maureen

Other than earning a small commission should you choose to join, I am in no way affiliated with Mary Hunt or Debt Proof Living. Heck, I’m not sure they don’t even know how much I love what they do!!